Table of Content

This process may take a little longer if you are self-employed, or if you have a past foreclosure, bankruptcy, IRS lien or poor credit. Also, as mentioned earlier, “pre-qualified” and “pre-approved” have different meanings. But they are often used interchangeably, so be sure your lender is actually going through the pre-approval process if that’s what you intended. In most cases, conditional loan approval with a mortgage loan process also includes a hard credit inquiry. If you want to move forward with your mortgage broker, you will need to fill out an official mortgage application.

An Underwriter ultimately decides what is required for a full loan approval. The Underwriter will review the file and send the Processor a list of “conditions” that need to be met prior to issuing the “clear to close”. The biggest mortgage fraud red flags relate to phony loan applications, credit documentation discrepancies, appraisal and property scams along with loan package fraud.

Want to discuss your home loan needs? We’re here to help.

But Realtors generally prefer a preapproval letter over a prequalification letter. At least three business days before you’re scheduled to close on your mortgage loan. Shopping around for a mortgage by applying to multiple lenders helps home buyers compare interest rates and fees and choose the deal with the most favorable terms. Finding a mortgage that best fits your financial standing can save you a lot of money over the life of the loan. See your recommended mortgage solutions and adjust your numbers to fit your budget. This is where you’ll see how much we can approve you for, as well as recommended types of home loans, down payments, monthly payments and interest rates.

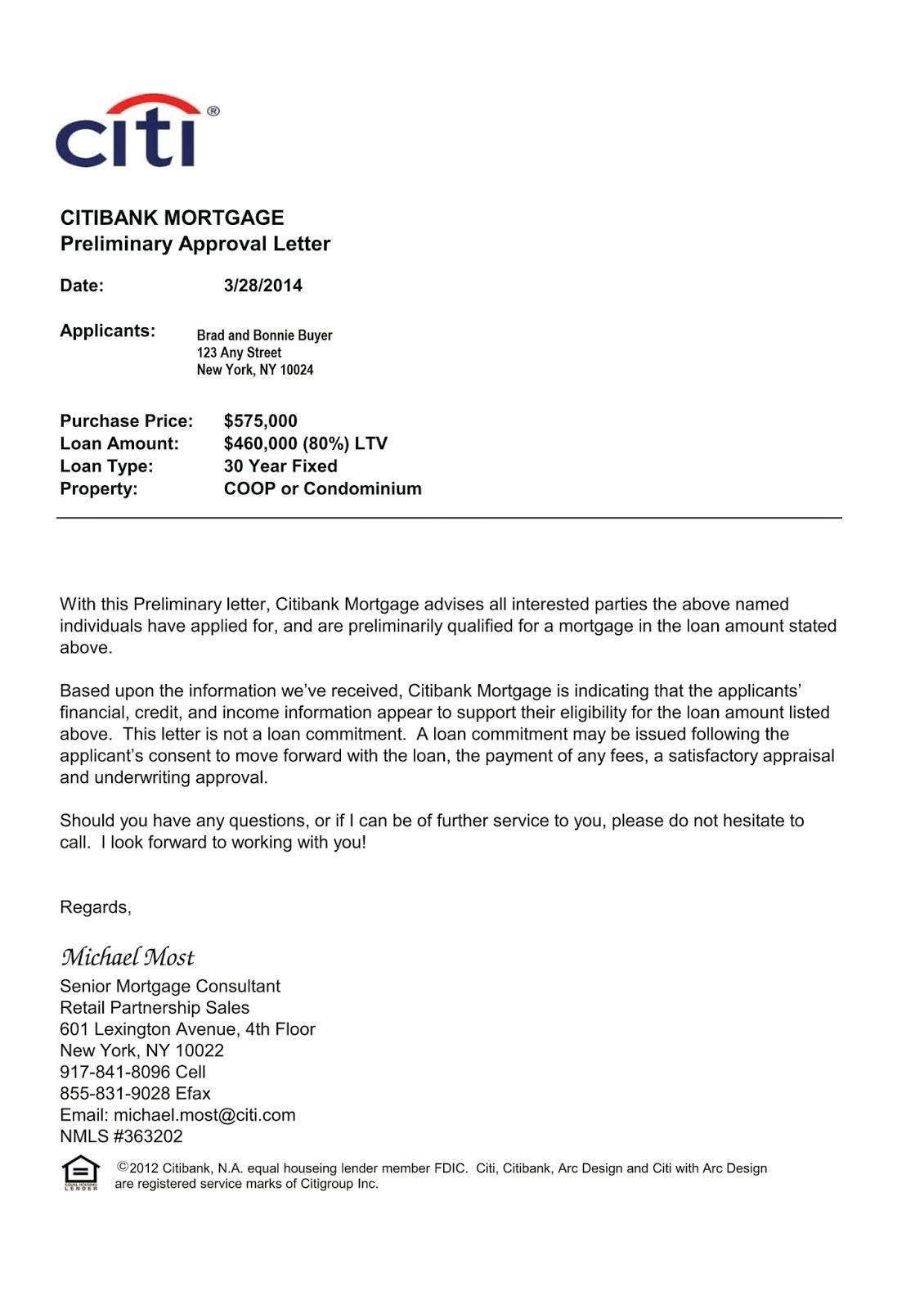

When a home buyer is pre-approved that means a lender has agreed to let them borrow up to a particular amount for a home purchase . The outcome is a pre-approval letter that can be submitted to a seller to reinforce a proposed purchase offer. The outcome of getting pre-approved is receiving a pre-approval letter. This letter is the golden ticket that allows you to be seriously considered by a seller to purchase their home. Without one, your chances of winning the bid on a home with multiple offers is slim to none. Therefore, it’s good to know the process of how to get pre-approved for a home loan and other answers to commonly asked questions about mortgage pre-approval.

Conditionally approved vs. other types of mortgage approval

And so, although they may sound like a convenient option, you should think twice about taking on these loans. If you have a limited credit history, there are smarter ways to build your credit and borrow funds. Look into credit builder loans, secured credit cards, getting a cosigner for your loan, or becoming an authorized user on another person’s credit cards. A car title loan is a secured loan that uses a borrower’s vehicle as collateral.

Most of the time the conditions are minimal and administrative in nature.

Apply for a mortgage today!

If you choose to move forward with the loan and lender, you must convey your intent to proceed. Some lenders may lock your rate as part of issuing a Loan Estimate but others may not. If your interest rate or loan details change, you may receive a revised Loan Estimate. You don’t need to have a signed contract for the property that you’re receiving a Loan Estimate for.

Choosing the right mortgage loan and lender is a critical step in the homebuying process. Make sure you’re getting what you expected, and when in doubt, always ask questions until you feel comfortable with the loan you’re able to commit to. While you need to include a property address on your Loan Estimate application, you don’t need a signed contract on a home. Ideally, you’d be requesting quotes from several lenders before you enter into a contract to buy a house.

Pre-Settlement Inspection Checklist

Lenders do not employ the valuers, they are separate entities. For a more thorough assessment, they will ask you to send the basic documents that lenders require. The SAF and the supporting documents will help brokers make a full preliminary assessment. Home Loan Experts’ mortgage brokers act in your best interests and provide you the best home loan advice you can get. LTV, or loan-to-value ratio, measures the size of your loan compared to the value of the home you’re buying. An LTV of 90 percent means the loan size, or lien, is 90 percent of the home’s value.

They will explain how each loan works and what it costs, including interest rates, features, fees and additional charges. It’s also your opportunity to clear up any confusion you have about the process before you get started. Credit requirements for homeownership vary between lenders and loan types. Typically, FHA loans require a credit score of at least 580; conventional and VA loans require a score of at least 620; and USDA loans require a credit score of 640 or higher. But lenders often set their own requirements which may be higher or lower. This process will help determine your debt-to-income ratio which helps lenders see whether you could afford the new loan’s monthly payments.

That means they'll agree a date to exchange contracts with the seller. Once the underwriter has determined that your loan is fit for approval, you'll be cleared to close. Certainly the hope is the if a lender pre-approves a buyer that the buyer will successfully obtain the financing, however, it's possible a mortgage can get denied even after pre-approval. A mortgage that gets denied is one of the most common reasons a real estate deal falls through. The lender and the complexity of the loan application determine the turnaround period. Some lenders want to see less information, while some want to see more.

They’ll also tell you how much they are willing to lend to you, and provide you with a pre-approval letter to that effect. The lender might also check your credit reports and scores at this stage. We find that people have an easier time understanding the mortgage loan approval process when it’s explained as a series of steps. So let’s talk about the six major stages that occur along the way . And made an offer, it’s time to have your loan application reviewed by an underwriter. At this point, it’s best to resolve all outstanding conditions as quickly as possible.

That’s when you move into the next step of the mortgage approval process — filling out an application. Most of the time, you can apply for initial approval online or over the phone with personal loans. Personal loan pre-approval will usually involve income estimates and a soft credit pull. A mortgage file is submitted to underwriting after the Processor has completed the processing stage of the mortgage. The initial underwrite of the mortgage loan process typically takes 48 to 72 hours.

Once you’ve been pre-approved for a certain amount, you can shop more confidently within that price range. And that brings you to the second major step in the mortgage approval process — house hunting. You can think of pre-approval as a kind of financial pre-screening. It has “pre” in the name because it happens on the front end of the mortgage loan approval process, before you start shopping for a home. For those borrowers looking to put solid offers on the table, a preapproval could be the best option.

When shopping for a mortgage, remember your rate doesn’t depend on your application alone. Your real estate agent will know the ins and outs of how to structure the offer. It should include contingencies that must be satisfied before the deal is complete. Similarly, real estate property taxes affect your payment amount. They may be lower in some neighborhoods or cities in your region. And, association dues for a condo can vary from building to building.

No comments:

Post a Comment