Table of Content

Pre-qualification is not as thorough because it commonly relies on the assembly of self-reported information. The prequalification process typically does not include pulling your credit report or reviewing financial documents. The lender will collect some basic financial information to determine how much you may borrow to purchase a home.

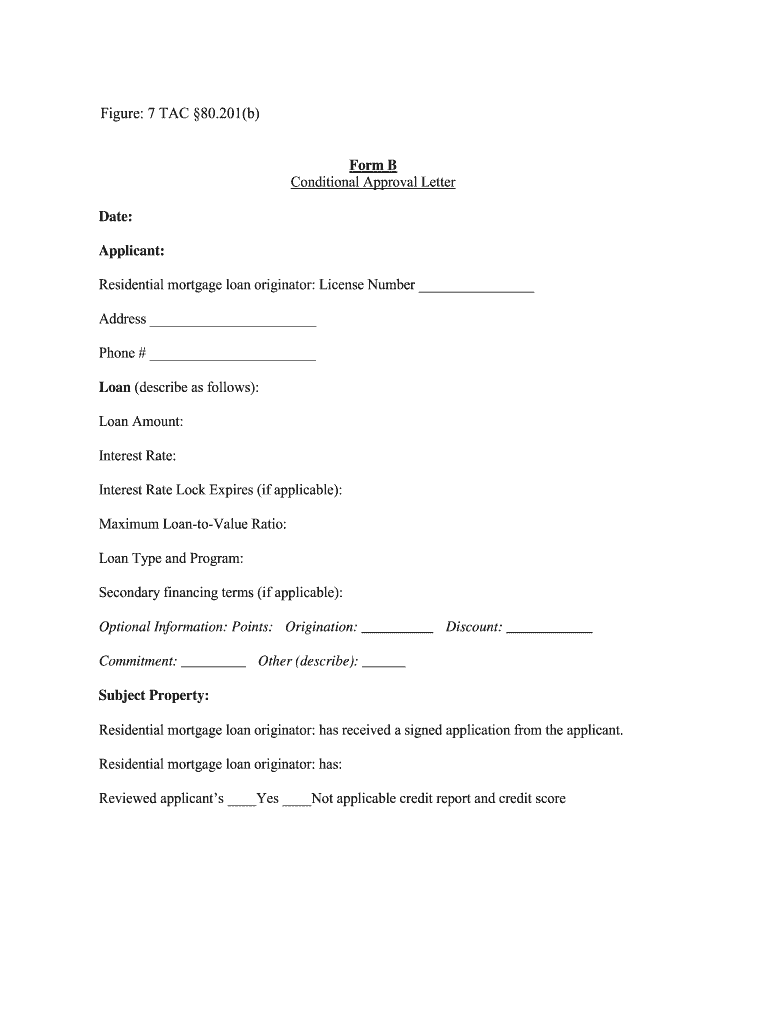

However, unless it’s an official Loan Estimate, your actual costs and rates could be higher. Remember, if your terms, rates or any other important information changes, you may also receive a revised Loan Estimate form. A conditional approval happens when a lender is otherwise satisfied with your loan application, but requires you to meet certain criteria before you can be fully approved. Being conditionally approved doesn’t guarantee you’ll be approved in the end, only that the lender is willing to loan you the money should you meet their pending conditions.

Home Loans For Bank Employees

You qualify for a mortgage and your mortgage team is moving forward with your home loan. These types of issues aren’t exactly common, but they could come up. The best way to avoid any problems with a loan application is not to take on extra debt, like a new car loan, and to keep your employment steady.

Broker or loan processing specialists will reach out to you for information if required. Underwriting is the process your lender goes through to figure out your risk level as a borrower. It involves a review of every aspect of your financial situation and history. They look at your income, bank accounts, investment assets, and your past reliability in paying back your loans.

Webinar: Mortgage basics: Buying or renting – What’s right for you?

Credit card cash advances allow credit card holders to borrow from their credit limits as cash instead of a credit transaction. Because you are already pulling from an existing credit card, there is no need for an approval process. One thing to keep in mind is that these cash advances have higher interest rates than credit transactions and are usually very limited. A standard personal loan is unsecured, meaning no asset is involved in the process. And so, in most cases, with personal loan approval, you won’t need to provide any information on an asset since there is none. After you've accepted our mortgage offer, your solicitor can start the final phase of buying your property.

This means the approval amount, loan program and interest rate might change as the lender gets more information. Because a prequalification is an initial review of your finances, you usually don’t need to supply documentation during this stage. Mortgage preapproval is the process of determining how much money you can borrow to buy a home. The next step in the mortgage loan process is processing and credit approval. The file is assigned to the Processor once it has been throughloan setup. The Processor works with the Underwriter, the Closer, and the title companyto close your loan.

How To Get Preapproved For A Mortgage

It is the amount of your monthly debt payments, compared to your gross monthly income. To know your DTI, use a mortgage calculator to estimate your monthly mortgage payment, and then add to it your other monthly debt payments. Underwriting is where the “rubber meets the road,” when it comes to loan approval. It is the underwriter’s job to closely examine all of the loan documentation prepared by the loan processor, to make sure it complies with lending requirements and guidelines. Credit card limit increases add to your purchase power with a credit card by increasing your available credit.

Underwriters have to protect the financial health of the lender. If your credit history, income, assets, and liabilities show you’re a higher risk applicant, the underwriter could deny your loan. Be sure you’re sharing up-to-date, accurate, and complete financial documents so your underwriter can get a precise picture of your financial life. Mortgage processing is when your personal financial information is collected and verified.

Top 10 Questions To Ask Your Mortgage Broker

The lender will provide you with a prequalification letter and this will show real estate agents and sellers you’re working with a lender. But, the prequalification letter is less valuable than a pre-approval letter because a lender has not yet verified your financial information. Once you have a purchase agreement and a completed loan application, your file will move into the processing stage. This is another important step in the broader mortgage loan approval process. A hard credit check will give your lender all the information they need for the final underwriting process. With a hard credit inquiry, they will be able to see all your information on your credit report, which includes things like your payment history and the amount of total debt you have.

In order to get a prequalification, your credit report is pulled to get a look at your median FICO® Score and at the existing monthly debt you have showing up in your credit report. You’re also asked for a verbal statement regarding your income and assets that you have saved. When you get preapproved, you usually get a preapproval letter. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they don’t waste time showing you homes outside your budget. While this may cause your credit score to drop slightly, getting preapproved won’t hurt your credit in a significant way.

Your statement on assets is used to determine how much you might be able to afford for a down payment. Here are some basic definitions around an initial mortgage approval. Yes, it is possible for a buyer’s mortgage to be denied after preapproval. This could happen because of an issue with the appraisal or guideline changes made by the lender. Our Verified Approval is a great way to strengthen your offer. We’ll do a full verification of your income, assets and credit so sellers can be certain you won’t run into financing issues.

This gives the seller more confidence in your offer due to less risk of the loan not getting approved and the purchase falling through. You will find many loans labeled as no credit check loans; payday loans usually fall under this umbrella. As the name suggests, these loans do not come with a credit check, and the screening process is minimal. However, with this ease of approval comes high-interest rates, low loan amounts, and extremely short repayment terms. Final approval for a loan will largely depend on the type of loan you are applying for.

You can stick with the lender you used during the pre-approval process or you can choose another lender. It’s always a good idea to shop around with at least three different lenders. You are NOT required to stick with the lender you use for pre-approval when you get your final mortgage. You can always choose a different lender if you find a better deal.

It is important to get pre-approved for a home loan because you want a good understanding of how much home you can afford to purchase. A personal loan is one of the most flexible loan types out there and can be used for all kinds of expenses. Loan amounts can range from a few hundred dollars up to a few thousand, depending on the lender you choose to work with.

No comments:

Post a Comment